Navigation

Do not use the "Back" or "Forward" buttons on your browser to navigate.

To exit, select another application from the tabs above or click on "Main Menu".

When you are finished, click "Log Off" at the top of the page to end your session.

Timeout

To maintain security and confidentiality, Service Credit Purchase Estimator will timeout in 20 minutes if there is no activity. If your session does expire, you must sign in again.

What is a Service Credit Purchase?

A service credit purchase is a payment to establish service credit in the University of California Retirement Plan (UCRP) for certain leaves of absence. By choosing to make a service credit purchase, you generally increase your retirement benefit.

Active UCRP members may elect a service credit purchase at any time. In most cases, a service credit purchase will cost less if elected within three years of returning to work at UC.

This application can be used to estimate the cost of a service credit purchase for 100% leave without pay periods that begin on or after July 1, 1997. Service Credit Purchase estimates for partially-paid sabbatical leaves may be included in a future release. To obtain service credit purchase estimates for partially-paid sabbatical leaves, extended sick leave, temporary layoff or furlough, reduction in workforce programs, previous UCRP membership, noncontributory offsets, or leaves prior to July 1, 1997, please contact your local benefits office.

For more information about a service credit purchase, see the UCRP Service Credit Purchase Guide [PDF] or your local benefits office.

Benefits of a Service Credit Purchase

Purchasing service credit for an approved leave may increase your UCRP benefits that are based on service credit:

- retirement income;*

- lump sum cashout;*

- disability income (although a service credit purchase will not help you to meet the minimum service requirement for disability benefits); and

- benefits paid after your death to your spouse or other survivor, if your death occurs after you retire or become eligible to retire.

Service credit purchase also counts toward UCRP vesting, eligibility for retiree medical coverage, and eligibility for preretirement survivor income. For more information about service credit and how it affects your UCRP benefits, see the appropriate summary plan description.

In many cases, purchasing UCRP service credit is a significant investment. It's important to weigh all of your options. The section "Is a Service Credit Purchase the Best Place for Your Money?" beginning on page 16 of the UCRP Service Credit Purchase Guide [PDF] can help you determine if a service credit purchase is a good investment for you. We also strongly recommend you consult a financial and/or tax advisor before deciding to elect a service credit purchase.

* A service credit purchase will increase retirement income, lump sum cashout, and postretirement survivor income payable from UCRP unless it would cause the benefit to exceed the maximum allowable benefit. See the appropriate summary plan description.

Approved Leaves

The following constitute approved leaves for the purposes of a service credit purchase:

- Approved leave without pay, partially-paid sabbatical leave, extended sick leave, temporary layoff, or furlough (except during a partial-year career appointment); and

- Reduction in Workforce Programs

- incomplete Time Reduction Incentive Plan (TRIP) agreement or completed TRIP agreement of less than 75 percent time; and

- reduction in appointment under Temporary Reduction in Time (TRIT) from 7/1/93 to 10/28/93.

Generally, a service credit purchase period must be a minimum of four weeks, though a shorter service credit purchase period may be permissible for circumstances such as a military leave or to qualify for UCRP vesting.

This Service Credit Purchase Estimator can be used to estimate the cost of a service credit purchase for 100% leave without pay that begin on or after July 1, 1997, are elected within three years of returning from the leave, and are up to two years long. To obtain service credit purchase estimates for partially-paid sabbatical leaves, extended sick leaves, temporary layoffs or furloughs, reduction in workforce programs, previous UCRP membership, noncontributory offsets, or leaves prior to July 1, 1997, please contact your local benefits office.

Assumptions

The calculations shown in this Service Credit Purchase Estimator include assumptions about appointment percentage, salary, and other figures that may impact the benefit amount received at retirement age. It also assumes current actuarial factors will remain unchanged until the projected retirement age. It is only an estimate and is not a guarantee of eligibility or benefit amounts. If you notice a data discrepancy or do not understand the data used in the calculations, contact your local benefits office.

The Service Credit Purchase Estimator calculations:

- assume leave percentage of 100%

- assume full time appointment percentage of 100%

- assume a monthly pay cycle

- use your highest average plan compensation (HAPC) without assuming any salary increases

- assume coordination with Social Security

- represent the estimated monthly benefit increase at age 60 (or actual age, if older)

- membership in the 1976 Tier

The Service Credit Purchase Estimator assumes Plan Normal Cost Method to calculate the cost of establishing service credit for the leave period. In some instances, such as if you were to elect a service credit purchase more than 3 years after returning from leave, or if you were to purchase a leave longer than two years, all or a portion of the calculation would instead be based on the Individual Actuarial Cost Method.

For complete information on service credit purchases, please refer to the UCRP Service Credit Purchase Guide [PDF] or contact your local benefits office.

Monthly Pay Cycle

Service Credit Purchase Estimator calculations assume a monthly pay cycle for your UC employment. Employees paid on a bi-weekly schedule may estimate a monthly salary rate by multiplying the hourly pay rate by 174 hours.

Plan Normal Cost Method and Individual Actuarial Cost Methods

The Plan Normal Cost Method uses the Normal Cost in effect at the time your estimate is calculated. This method applies the Normal Cost rate to the salary (covered compensation) you would have received if you had not been on leave, plus interest. The interest is computed using the Plan's assumed earnings rate at the time of the service credit purchase election, currently 7.25 percent. Interest is charged from the date you return to work to the date the service credit purchase payment is completed.

The Plan Normal Cost is actuarially determined and may change from year to year. For 2016, the rates for Plan Normal Costs are:

- 1976 Tier Members with/without Social Security: 18.72%

- 2013 Tier Members with/without Social Security: 15.96%

- 2016 Tier Members with/without Social Security: 15.96%

- Modified 2013 Tier Members with/without Social Security: 17.04%

- Safety Members: 25.22%

- Tier Two Members: 9.36%

Though you may be in a different member classification, the Plan Normal Cost for 1976 Tier members with Social Security is applied for all estimates prepared with this Service Credit Purchase Estimator.

The Individual Actuarial Cost Method more closely captures the actual cost of the additional benefit you will receive as a result of the service credit purchase. It is based on your age and salary rate at the time of the service credit purchase and industry mortality table; these factors are used to calculate the present value of the additional retirement benefit that will result from the service credit purchase.

Service Credit Purchase Estimator calculations assume Plan Normal Cost Method. In most cases, the cost of your service credit purchase is based on the Plan Normal Cost if you elect the purchase within three years of returning from a leave. If you elect a service credit purchase after three years, the cost is based on the Individual Actuarial Cost. If you elect to purchase a leave longer than two years, the cost to purchase the portion beyond two years is based on the Individual Actuarial Cost.

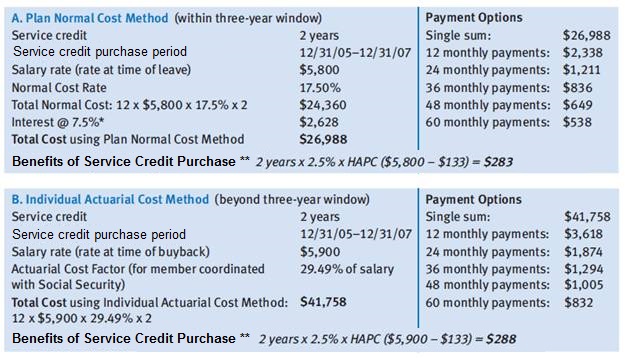

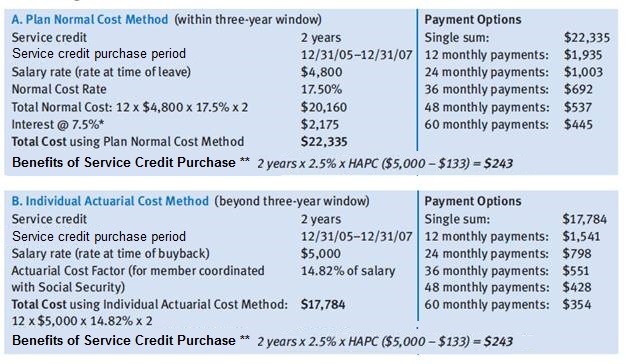

The two examples below compare the cost of using the Plan Normal Cost Method to the cost of using the Individual Actuarial Cost Method. Because age is also a significant factor in the calculations, examples for purchases at age 60 and age 35 are presented. NOTE: The below examples utilize the 2013 Plan Normal Cost of 17.50% for 1976 Tier members.

Example 1: Plan Normal Cost Method vs. Individual Actuarial Cost Method - Member age 60

Example 2: Plan Normal Cost Method vs. Individual Actuarial Cost Method - Member age 35

HAPC = highest average plan compensation

* Amount of interest will vary depending on the plan's assumed interest rate, the amount of time between the date you return to work and the date you begin a service credit purchase, and the length of the service credit purchase payment period you elect. The examples above reflect an interest rate of 7.5%. As of January 2016, the current interest rate is 7.25%.

** Estimated increase in monthly benefit payable at age 60 (or actual age if older)

Glossary

Additional Service Credit

The additional service credit amount is estimated based on the leave dates that you entered, and it may be added to the service credit you accrue while in an eligible position. It also assumes a leave percentage of 100% and a full time appointment percentage of 100%.

Basic Retirement Income (BRI)

Basic Retirement Income is generally the largest monthly retirement benefit you can receive from the University of California Retirement Plan (UCRP).

This benefit is based on a formula that includes:

- A factor based on your age at retirement,

- Your years of UCRP service credit, and

- Your highest average plan compensation (HAPC)

For members covered by Social Security, the Basic Retirement Income formula is:

(age factor) x (service credit) x (HAPC - $133)

For more information, see the appropriate UCRP summary plan description.

Highest Average Plan Compensation (HAPC)

Highest average plan compensation (HAPC) is the average monthly full-time equivalent covered compensation during your 36 highest continuous months preceding retirement. If you have worked for UC less than 36 months, your calculation is instead estimated using an average of the plan compensation during the months you have worked.

Modified 2013 Tier Members

Modified 2013 Tier Members are those who are represented by bargaining units for CNA (NX), UPTE (HX, RX, TX), and AFSCME (EX, SX, K7).

Social Security Coordination (Offsets and Supplements)

Social Security Offset is one of the offsets built into the basic retirement income formula. The Service Credit Purchase Estimator assumes you are covered by Social Security, so your basic retirement income is reduced slightly to account for the Social Security taxes that UC has paid on your behalf. If you retire before age 65, UCRP provides a monthly temporary supplement described below. The offset is part of the benefit formula and continues to be applied for your lifetime. The lump sum cashout calculation includes the offset, but not the temporary supplement. The formula for the offset is:

(age factor) x (service credit) x $133

Social Security Supplement is the temporary supplement equal in amount to the Social Security Offset described above. If you retire before age 65, UCRP provides this monthly temporary supplement. This supplement stops when you reach age 65. The lump sum cashout calculation does not include this supplement.

Questions or problems

For complete information on service credit purchases, please refer to the UCRP Service Credit Purchase Guide [PDF], or contact your local benefits office.

If you notice any data discrepancies, please contact your local benefits office or the Retirement Administration Service Center (RASC).